Part I

The unseasonably cold winter of ’13-’14 caused record natural gas prices in the Northeast and left us with a record low supply in storage. Coupled with the lack of infrastructure to accommodate demand, businesses and homeowners in the Northeast will continue to feel last winters impact on prices as we enter this year’s cold season. In fact, if we experience another cold winter extreme, it is likely that we will see even higher prices.

In part II of this article we will look at the impact of pipeline constraints compounding the risk of another cold winter as well as some additional factors currently threatening the prices of natural gas in the U.S., particularly in the Northeast. The situation is volatile and unpredictable, leaving many businesses and consumers unsure of what to expect for heating costs this winter.

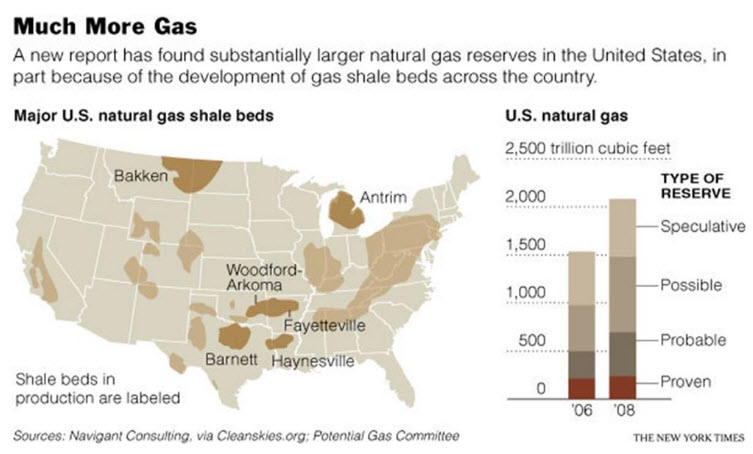

The Natural Gas Resource

Natural gas is plentiful in the U.S. and recent discoveries of new shale beds are only brightening the outlook. In 2006, estimated raw natural gas in the U.S. was just over 1500 TCF (trillion cubic feet). With the discovery of gas trapped in between layers of Shale rock throughout the U.S. this number is now estimated to be just above 2,000 TCF.

One of these recently discovered Shale deposits is the Marcellus bed in the Northeastern U.S. It is estimated that 500 TCF could be recovered from bed, which stretches from New York through Pennsylvania, ending in West Virginia.

Until recently the technology to reach these deposits had not been available. However, with the “fracking” technique now being used successfully throughout the U.S. it is clear that these deposits could have a large impact on natural gas consumption in the U.S.

Cold Temp Effects on Prices: The Record Cold Winter

Credit: Competitive Energy Services (www.competitive-services.com)

Colder temperatures have an exponentially negative effect on heat load, which is the quantity of heat per unit of time (i.e. mmcf/d) that must be supplied to maintain the temperature in a building or portion of a building at a given level.

This means is it gets colder it becomes highly inefficient to properly heat a building which increases prices drastically as demand for gas increases. The unseasonably cold ’13-’14 winter caused building and homes to consumer more gas, dipping further into supply than ever before.

The number of Heating Degree Days, a measurement designed to reflect the demand for energy needed to heat a building derived from measurements of outside air temperature, reached highs far above average and much higher then either of the last two winters. Further, the colder weather lasted well into April 2014, creating a longer heating season.

Credit: Competitive Energy Services (www.competitive-energy.com)

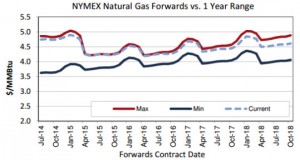

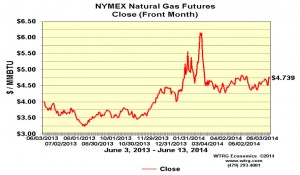

This caused prices to spike, into the $4.50-$6.00/MMBtu range, with a record high for the Northeast occurring on January 23, 2014. Average prices are typically $3.00-$4.00/MMBtu, but well into the summer months of 2014 natural gas futures on NYMEX were still hovering between $4.50-$5.00/MMBtu. These higher than average prices will be the baseline going into the ’14-’15 winter.

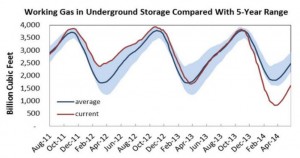

This unpredicted increase in gas consumption left us with record low supply at slightly below 1000 BCF in storage. Compared with the 5 year range, the average should lie at about 1,750 BCF in storage, which is already at the low end of an acceptable range. As a result of this the current NYMEX futures contracts for natural gas are riding the maximum projected line without showing signs of breaking until the ’17-’18 season.

In short, if we experience another winter similar to last year, the Northeastern U.S. will be looking at significant and lasting natural gas price increases. This is troubling news in the still slow moving post-recession years for an industry that affords the luxury of low natural gas prices to the U.S. compared to the rest of the world.

In short, if we experience another winter similar to last year, the Northeastern U.S. will be looking at significant and lasting natural gas price increases. This is troubling news in the still slow moving post-recession years for an industry that affords the luxury of low natural gas prices to the U.S. compared to the rest of the world.

Coming soon will be part II of this article where we’ll examine risks in addition last year’s record cold winter. These include pipeline constraints to the Northeast, proposed solutions and macro-economic and political factors which could vastly change the natural gas industry in the U.S.

Joe Scicutella is an energy procurement analyst for Cost Control Associates. He helps his clients obtain energy supply at the optimal price. He keeps his thumb on the pulse of the energy marketplace by monitoring supply, providing insights, working with suppliers to obtain pricing and negotiate contracts. Joe currently manages more than $2.5 billion in total client annual spend and has saved his clients more than $2.8mm on costs since July 2019. Learn more.