Part II

Another Record Cold Winter Could Mean Trouble for Natural Gas Prices in the Northeast

In part one of this article we looked at how the unseasonably cold ’13-’14 winter caused an unpredictable rise in natural gas prices for the Northeast. The winter was colder and lasted longer than expected leaving us with record low supply levels and higher than average prices going into this year’s cold season.

The question begs, what happens if we experience another record cold winter? It is clear that we weren’t prepared for last year which has left us even more woefully unprepared for this season.

Unfortunately there is no good answer to this question. In addition, there are a few potentially significant risks to the natural gas market in the Northeast, not the least of which is lack of infrastructure to adequately fulfill demand.

Pipeline Constraints

The pipeline infrastructure that supplies the Northeast with natural gas has remained unchanged for over 13 years and is currently maxed out. This means that any significant change in status quo, for example, a record cold winter, is going to threaten supply and drastically increase prices.

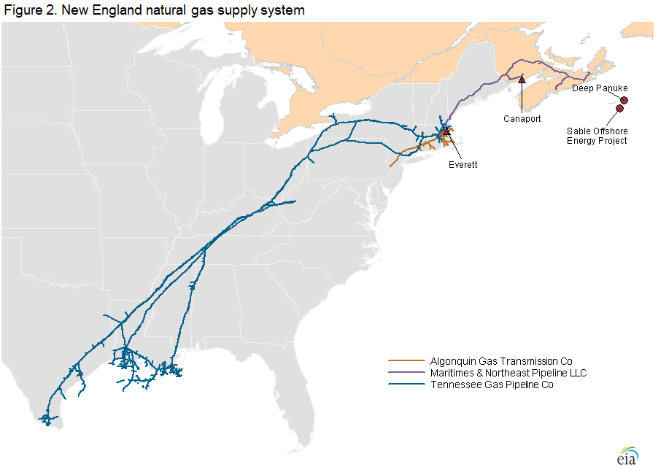

The Northeast primarily receives natural gas from the U.S. Gulf Coast and of the eastern shore of Canada. While supply isn’t diminishing from these

sources, our ability to transport that supply hasn’t grown with demand. This can be seen in the two primary hubs through which we receive this gas in the Northeast, the Tennessee Gas Pipeline Zone 6 (TZ6) and the Algonquin Citygates (AGT). Both hubs have been experiencing a run up in natural gas basis since 2011, with basis futures exploding over last winter from roughly $4.00 in August of 2013 to around $10.00 in June of 2014.

Natural gas basis is the cost to transport the gas through interstate pipelines from the wellhead to your utility. It includes supplier costs such as credit, margin, scheduling and balancing services. The trouble with these costs is that they’re not equally shared by the utility, and are often “passed along” in full to the end user.

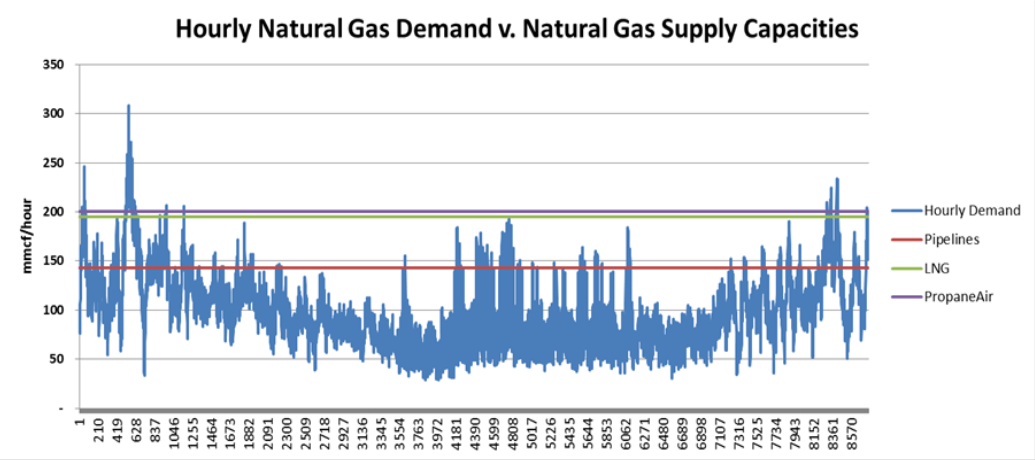

In the graph below you can clearly see that hourly demand last winter spiked above total pipeline supply capacity for the Northeast at several points throughout the months depicted. These spikes were caused by the unseasonably cold ’13-’14 winter. With even lower supply going into this winter it is clear that demand could spike even higher, causing prices to skyrocket.

Credit: Competitive Energy Services (www.competitive-energy.com)

Proposed Pipeline Solutions in the Northeast

Credit: Competitive Energy Services (www.competitive-energy.com)

The good news is there are several projects in the works to expand the infrastructure that supplies natural gas to the Northeast. The bad news is it could be a minimum 2-3 years before they reach completion, best case scenario. There are 3 projects in the works, but have been hit with delays due to a number of factors, the most notable being public concern for the environment. Several projects have been put on hold for environmental impact studies.

The newly discovered shale gas beds in the Northeast could have a huge impact on supply and basis in the Northeast, however with public concern over fracking, the infrastructure to move this supply has not yet come to fruition. In some states, like New York, fracking isn’t legal, leaving a vast amount of supply untapped.

Until this newly discovered supply in the Northeast and the infrastructure to move it to demand centers exists, we will continue to have to tap the already stressed pipeline infrastructure in place. In part III of this series we’ll discuss several macroeconomic and political factors around the world that, with any significant change, could have considerable impact on natural gas prices in the U.S.

How prepared is your business for the coming winter?

If you are concerned about your energy costs, please contact Kevin Laake at Cost Control Associates, 518-798-4437.

Joe Scicutella is an energy procurement analyst for Cost Control Associates. He helps his clients obtain energy supply at the optimal price. He keeps his thumb on the pulse of the energy marketplace by monitoring supply, providing insights, working with suppliers to obtain pricing and negotiate contracts. Joe currently manages more than $2.5 billion in total client annual spend and has saved his clients more than $2.8mm on costs since July 2019. Learn more.