Part IV

Another Record Cold Winter Could Mean Trouble for Natural Gas Prices in the Northeast

In the U.S., pressure to shift away from coal to cleaner energy sources has increased our reliance on natural gas. Coal, which traditionally made up 50% or more of the energy mix in the U.S., has dropped to below 35%, while natural gas jumped above 30% from 15% in 2000.

The shift means that the price of electricity will be tied even more closely to the price of natural gas. This could mean trouble for natural gas prices in the Northeast, which saw record spikes during last year’s winter, the effects of which will continue to impact natural gas and energy prices this winter.

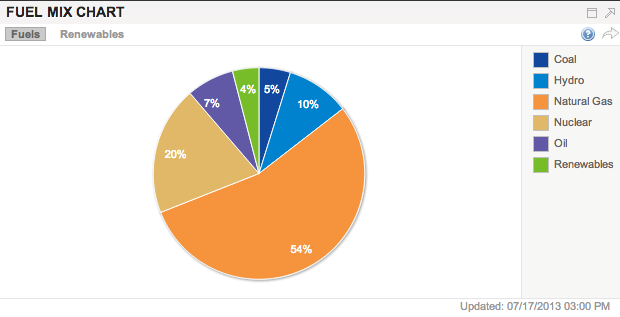

Northeastern U.S. Energy Mix

The natural gas market is somewhat volatile, even more so in the Northeast, which is lacking infrastructure to meet demand. While cleaner for the environment, too much dependence on natural gas for energy in the Northeast could have a big impact on energy costs in coming years.

Currently natural gas makes up about 54% of the Northeastern energy mix, with nuclear energy making up about 20%. The problem is that many of the base load retirements in the coming years will be from nuclear power plants going offline.

As we decrease dependence on coal and nuclear energy production, the emphasis on natural gas in energy supply will increase. This new emphasis comes at a time in which the Northeast lacks adequate infrastructure to supply demand. There are several other risks that could threaten the natural gas market, drastically raising prices for Northeastern businesses and homeowners.

Natural Gas and the Price of Energy

Natural gas trading causes price volatility and spiking prices, which can be exaggerated by weather, bad news and other threats. As natural gas usage grows in the Northeast, the price of electricity will likely begin to mimic the price of natural gas, making it subject to similar price spikes.

Natural gas trading causes price volatility and spiking prices, which can be exaggerated by weather, bad news and other threats. As natural gas usage grows in the Northeast, the price of electricity will likely begin to mimic the price of natural gas, making it subject to similar price spikes.

Last winter, the price of electricity reached as high as $350/MWh, significantly higher than the typical $200-$250/MWh highs. Much of this increase was influenced by record spikes in natural gas prices. A look at the spot prices for energy last winter compared with the rest of the country shows that the Northeast was paying 3 to 4 times more for most of the winter season.

With rising prices, projected prices increases over the long term and limited supply line capacity, this trend shows no sign of slowing any time soon.

What Needs to Happen to Realize Reasonable Energy Prices

The Northeast needs diversity in its energy base to take pressure off natural gas. According to NESCOE, a not-for-profit organization representing the collective interests of the six New England States on regional electricity matters, there are a two things that need to happen in the short term to ensure reasonable energy prices.

The Northeast needs diversity in its energy base to take pressure off natural gas. According to NESCOE, a not-for-profit organization representing the collective interests of the six New England States on regional electricity matters, there are a two things that need to happen in the short term to ensure reasonable energy prices.

The first is the development of new transmission infrastructure for clean energy. New infrastructure would bring in hydroelectricity via a pipeline through the northern pass from Canada into New Hampshire and the rest of New England.

The second is increased capacity to supply natural gas to the northeast. This requires new pipelines that will reduce natural gas basis, and reducing the pass along cost from suppliers to consumers. There are several plans for new pipeline projects in place; however completion of these projects isn’t likely for several years.

The primary challenge in making real progress on these issues is finding agreement among Northeastern states. Many projects hit delays because of regulatory issues, public concern and costly environmental studies. These delays only prolong the agreed inevitable need for change. A hydroelectricity transmission could bring great relief to the natural gas dependent Northeast, however widespread access to the plentiful resource isn’t likely anytime soon.

Conclusion

The Northeast is more dependent on natural gas for energy than ever before. Until we can find some diversity in the energy mix, the cost of electricity will be tied very closely to that of natural gas.

If, or more likely when, a spike causing lasting increase in natural gas prices occurs, electricity will spike too, putting Northeastern businesses and consumers at a disadvantage. When that occurs cost control will no longer be preventative but will become necessary to survive.

Eventually relief from alternative energy sources like hydroelectricity could present some opportunity to diversify in the Northeast. However, until these alternative sources of energy become widely accessible across the Northeast, the procurement of energy will continue to be of utmost importance to managing acceptable operating costs.

Questions on efficient Energy Procurement for your business?

Please contact Keith Laake at Cost Control Associates, 518-798-4437.

Keith Laake founded Cost Control Associates, Inc. in 1991 and has been responsible for strategic planning, marketing and sales, and overall management of the firm. He currently focuses on business development. Keith received his BBA from the University of Wisconsin and is a certified public accountant. Learn more.